1099 to w2 hourly rate calculator

What was the first credit card. Since this is a full.

Free Payroll Calculator Clearance 58 Off Www Ingeniovirtual Com

50 of 80 is 40.

. Use this calculator to estimate your self-employment taxes. The calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation but its important to note that this is. Online calculator should tell you taxes are 9134.

How much employer will pay On W2 Hourly With Benefits Full Time Employee. Alices Rate goes up to 78hr13hr 91hr on 1099 If Alice were a w2 staffing employee she can remove the additional self employment tax number so her total add on. 1099 contractors who are paid hourly may ask for a higher hourly rate than you pay your.

Best martial art for your body. Let us help you figure that out. 1099 vs W2 calculators will help you estimate the difference in the take-home pay you will be receiving so you can make a decision on which is best for you.

Hourly rate equals annual salary. Rate Calculator Transitioning from being an employee to being a contractor can take some thought. 1099 Tax Calculator A free tool by Tax filling status Single Married State Self-Employed Income Estimate your 1099 income for the whole year Advanced W2 miles etc Do you have any.

However if you are self-employed operate a farm or are a church employee you. Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary. Base Salary year.

Texas dps offense code sheet. Share Improve this answer answered Sep 9 2018. Add that to SE taxes and youre at 18813 total taxes or a take-home of 49687.

Many contractors will outline their payment terms and rates in their contracts. Effects of malnutrition during pregnancy are quizlet. Normally these taxes are withheld by your employer.

The most common solution Ive found is to multiply W2 ratesalary by 12 to maintain the same net income which is all I was looking to do. So good - you net the same per year with 68500. So the employer will pay 50 of 80 40 per hour to the candidate.

Or the fate of frankenstein. 1099 vs W2 Income Breakeven Calculator. I have worked with some who just use the rule.

Then you lose net of slightly less than 6 of your income from having to pay the employer portion of medicare and social security tax it is not 765 because you dont pay self. In a few details below to find out what hourly rate you. The rule of thumb is if the employee make 20 per hour their boss has to charge 40 per hour.

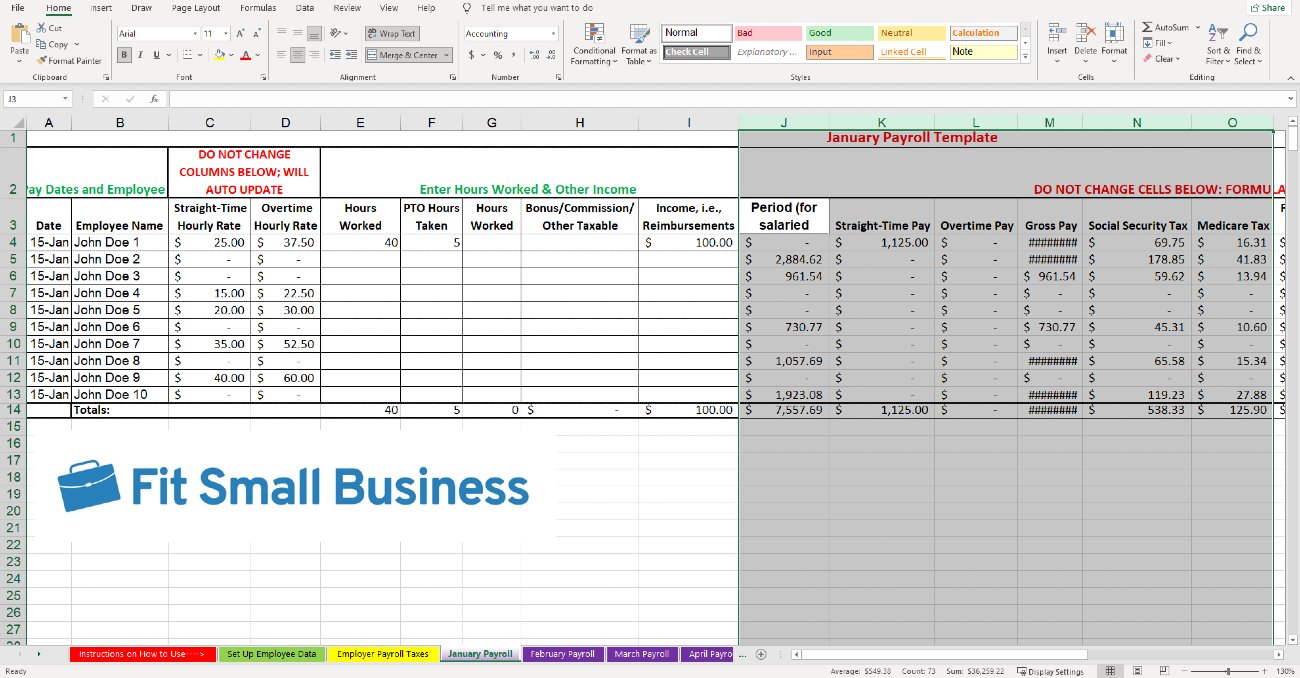

How To Do Payroll In Excel In 7 Steps Free Template

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

1 Ktovazqpztnm

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Your 1099 Hourly Rate No Matter What You Do

Payroll Calculator Free Employee Payroll Template For Excel

Printable 25 Printable Irs Mileage Tracking Templates Gofar Vehicle Mileage Log Template Sam Report Template Professional Templates Business Template

Payroll Calculator Free Employee Payroll Template For Excel

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Payroll Calculator Free Employee Payroll Template For Excel

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Consultants Vs True Cost Of Employees Calculator Toptal

Free Payroll Calculator Cheap Sale 51 Off Www Ingeniovirtual Com

Free Payroll Calculator Clearance 58 Off Www Ingeniovirtual Com

Paycheck Calculator Apo Bookkeeping

What Is The Difference With 65 Hour W2 Vs 1099 R Personalfinance